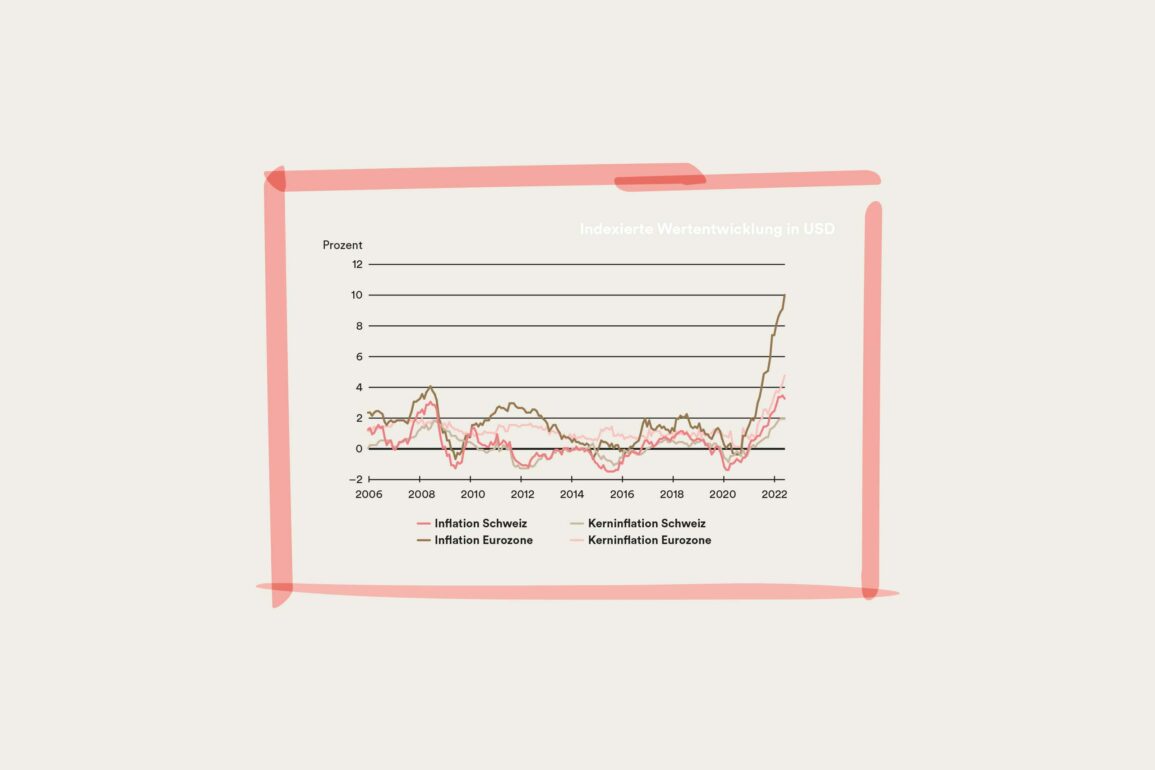

Consumer prices have been on the rise for more than a year and have now reached record heights. This unusually high level of inflation is the result of various factors.

Global supply chain issues, coronavirus lockdowns and exceptionally expansive monetary and fiscal policy are just some of the reasons why price rises have been so swift. Plus, energy prices have risen sharply due to the war in Ukraine. Lots of investors are rightly asking how they can hedge against the increasing price pressure. To answer this question, we look at the most prominent asset classes: equities, bonds, gold and real estate.

Equities

Historically, equities have developed particularly well in environments with moderate, stable inflation, since a low level of economic uncertainty enables companies’ profits to be forecast reasonably well. However, if price levels spike without warning, this can create massive distortions on the stock markets. Sudden price rises pose a

risk to operational margins as higher production costs cannot be passed on to customers immediately. Higher inflation levels force central banks to adopt a more restrictive monetary policy with higher interest rates, which causes stock valuations to shrink due to increasing future dividend discount factors. Plus, the measures to combat inflation cloud the prospect of growth, increasing the pressure on equities.

However, it is worth making a distinction within the equities asset class, as not all sectors are equally affected by inflation. This is illustrated by an analysis of stock market returns over the last 50 years: in an environment marked by increasing, low inflation, companies in the IT sector had the highest returns, while the defensive sectors of consumer staples, healthcare and utilities underperformed. During periods of consistently high inflation, commodities and energy fared the best and financial stocks the worst. Commodity-related sectors dominated when inflation rose to more than 6%, while consumer-related sectors and the IT sector were ones to avoid.

Bonds

Bonds with a fixed coupon and pre-defined repayment at maturity (par value) are heavily sensitive to changes in inflation. The fixed coupon payment reflects inflation expectations at the time of issue and is not amended subsequently, even if market conditions change. If inflation accelerates, the discounted future coupons and redemption are worth less today, leading to a temporary price loss of the bond. The longer the remaining term of the bond, the greater this loss. Inflation-linked bonds, known as ILBs, offer long-term protection against rising inflation. The nominal value of an ILB is linked to realised inflation and thus guarantees a real return regardless of inflation. However, ILBs are not issued in Swiss francs.

Gold

Gold has always enjoyed a reputation as a good protector of assets from currency devaluation. This is because only a limited amount occurs naturally, it has a stable demand due to its usage in various industrial processes, and it cannot be devalued as a result of monetary policy. But gold has not always lived up to its reputation. An inflation-hedging investment should keep pace with consumer prices. However, in periods of high inflation accompanied by highly restrictive monetary policy, gold has generally generated a negative return for investors.

The development of real interest rates, i.e. interest rates minus inflation, is more important in the valuation of gold than the properties mentioned above. Since gold does not yield an income return in the form of interest payments, investing in gold involves weighing up the potential price gains against the interest earned on cash. The higher the real interest yield, the less attractive gold becomes.

Real estate

Real estate offers more direct protection against inflation. Generally, commercial leases in Switzerland are linked to inflation. Residential rents are usually tied to a relatively sluggish reference interest rate and only to a lesser extent to consumer prices. Inflation and interest rates can thus be passed on to rents, but only with a delay. However, the higher discount rates have a direct impact on the valuation models, which is why real estate funds and companies have had to record similarly high losses as shares this year. In the longer term, however, real estate should offer good protection against inflation.

In volatile times, it is important to keep several options open in order to be able to react promptly. For the management of foundation assets in particular, a constant, proactive adjustment of the tactical asset allocation, taking into account the foundation’s risk capacity and risk tolerance, is key to ensuring the organisation can meet its objectives as set out in its articles of association.