The coronavirus came as a bolt from the blue. We cannot predict events such as this, but we can make the most of the opportunities they bring. The challenge is to recognise these investment opportunities at an early stage and use their potential to benefit the portfolio.

The year 2020 began positively for the financial markets. Share prices rose in almost all asset classes before the coronavirus brought this trend to an abrupt end in mid-February. Within a very short space of time (24 trading days) global shares lost over a third of their value. The markets had never witnessed such a rapid fall. Even during the dot-com bubble of 2000/01 or the 2007/08 financial crisis, it took over a year for the markets to report similar losses.

However, while the markets took a quick hit, prices recovered just as rapidly. Thanks to determined intervention on the part of various central banks and a range of national stimulus packages, the financial markets are defying the pandemic. Global share prices have almost completely recovered after the annual low.

Nevertheless, years of expansionary monetary and fiscal policies are bound to have consequences. Up until now the money from the central banks’ bailouts has primarily flowed into the financial markets, allowing prices to rise in almost all asset classes. If, one day, the money finds its way into the real economy, it will cause inflation. A rise in inflation can be offset by increasing the base rate. However, given rising national debts in the wake of the coronavirus crisis and the high interest burden associated with these, this would be a somewhat problematic move.

What should a non-profit organisation do to adjust its portfolio in a time of pandemic?

It looks as if the coronavirus will be with us for some time. Until a vaccine becomes a real prospect, the financial markets will be plagued by uncertainty. To avoid having to sell at rock bottom prices during this time, it makes sense for a non-profit organisation to build up a liquidity reserve for payouts. Because NPOs serve a long-term purpose, however, the majority of the organisation’s assets should be invested.

Below we highlight a few of the investment opportunities open to you in a time of pandemic:

Monetary and fiscal policies boost share prices

With base rates at a historic low – and likely to remain unchanged over the medium to long term – and central banks indicating a readiness to continue with their expansionary approach to monetary and fiscal policy, our preference is for shares. Given the uncertainty surrounding the coronavirus and a potential escalation in the trade dispute between the US and China, we expect the fluctuation of share prices to increase. We therefore favour shares with low volatility, complemented by high-quality shares (see issue 1/20, pp. 32–33). Swiss francs have always been considered a safe choice. We therefore prefer Swiss investments to foreign securities. Local companies such as Nestlé, Givaudan and Lonza are currently among our particular favourites.

Going for gold

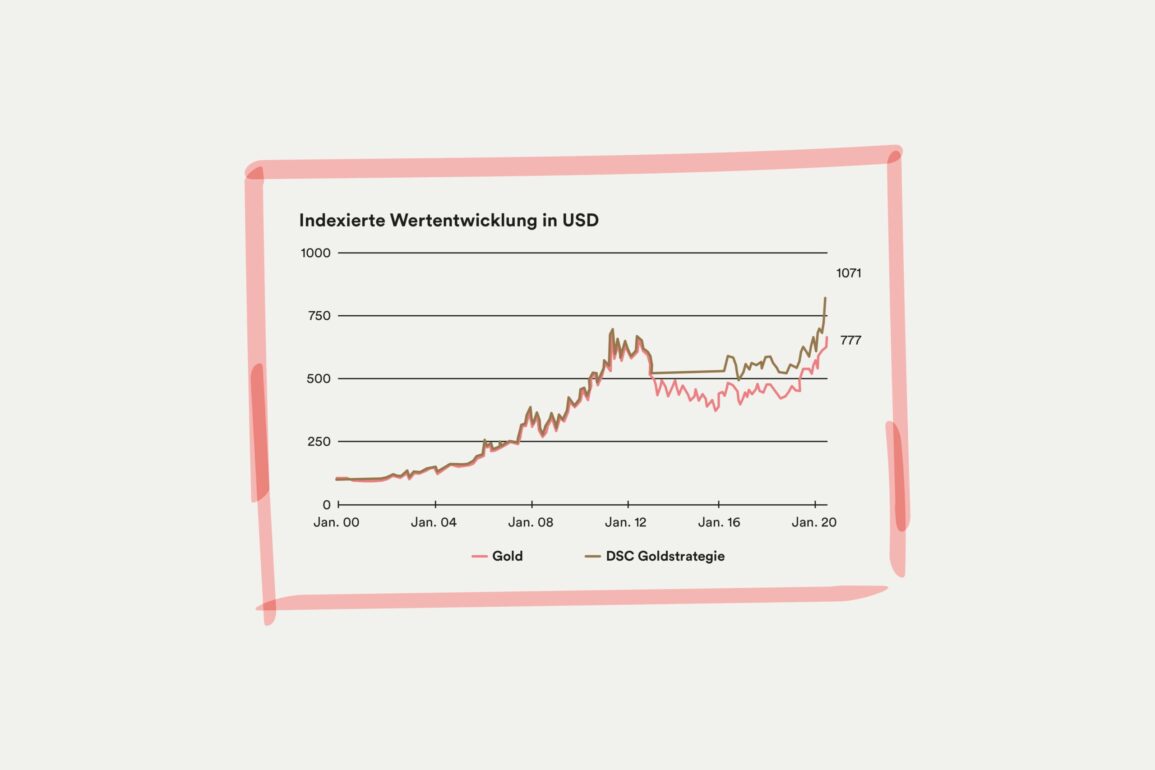

Like the Swiss franc, gold is also considered a safe choice in turbulent times. Unlike other precious metals – platinum or silver, for example – gold is exempt from VAT. It is important, however, to bear in mind that, unlike other types of investment, gold does not yield a generic return, i.e. there are no dividends (as with shares) or coupons (as with bonds). Success is determined by the forecast price alone. The price of gold rises if, for example, the expected real interest rate (in other words the difference between the expected nominal interest rate and the forecast inflation rate) falls or is low. Our proprietary gold indicator combines these real interest rate expectations with gold-specific risk indicators and trend signals. At the end of May 2016, it generated a buy signal at a price of 1,212 US dollars per troy ounce. As a result, we increased our gold allocation to a maximal weighting. The price of gold is currently 1,948 US dollars, an appreciation of over 55 percent, or 11 percent p.a. (in US dollars). Since the beginning of the year, gold has been the best performing asset class. Our indicator continues to give us grounds for optimism and is forecasting bright prospects for the precious metal.

A crisis opens up opportunities

To sum up, in times of crisis, opportunities always arise. It is important to recognise those opportunities early on and to adjust your organisation’s portfolio tactically. While focusing on the opportunities, it is also crucial to bear in mind the risks associated with the investment. Implementing your investment strategy in a professional and disciplined manner and seizing tactical investment opportunities will ensure that nothing stands in the way of your non-profit organisation’s financial success.