When a charity invests its assets, several conflicting criteria need to be met. The first step you take as an investor is to work out your target. This takes the form of expected returns or a risk budget. There are five conditions you need to bear in mind here: the investment horizon, the need for liquidity or regular capital, tax and legal aspects, and individual restrictions e.g. no investments in tobacco or arms.

The task of a professional asset manager is to achieve your target while respecting the conditions defined by you.

The investment strategy for a charity’s portfolio

Usually, charities’ funds are invested in line with a defensive strategy. Generally, bonds are the core of a charity’s portfolio, but the returns on bonds have been tumbling lower and lower over the past few years. At present, Swiss bonds even generate negative returns, regardless of their duration.

Have you met T.I.N.A.?

This development begs the question as to what investments are available as an alternative to bonds. It’s time to meet ‘T.I.N.A.’. T.I.N.A. stands for ‘There Is No Alternative’, and suggests that the low-interest rate environment means there is no alternative to shares.

Recently, many boards of trustees have decided to increase the proportion of shares in their portfolio. Until now, this was the right decision to make, with prices on the global stock market almost tripling since the 2007/8 financial crisis.

Recently, the stock markets are bouncing from one all-time high to the next, but plenty of investors are already viewing this development with suspicion. While share prices grew by about five percent per annum in the distant past, these figures have almost doubled since the financial crisis. Given this development, it is only fair to ask how long this trend can continue.

It’s hard to pick the right point at which to sell shares: there are an array of early indicators that can be harbingers of a crisis on the stock market, but they are tricky to identify.

A market anomaly: more returns, less risk

It’s easier to prepare your portfolio for a crisis, even when share prices are shooting skywards. How? By making the most of an anomaly on the financial market.

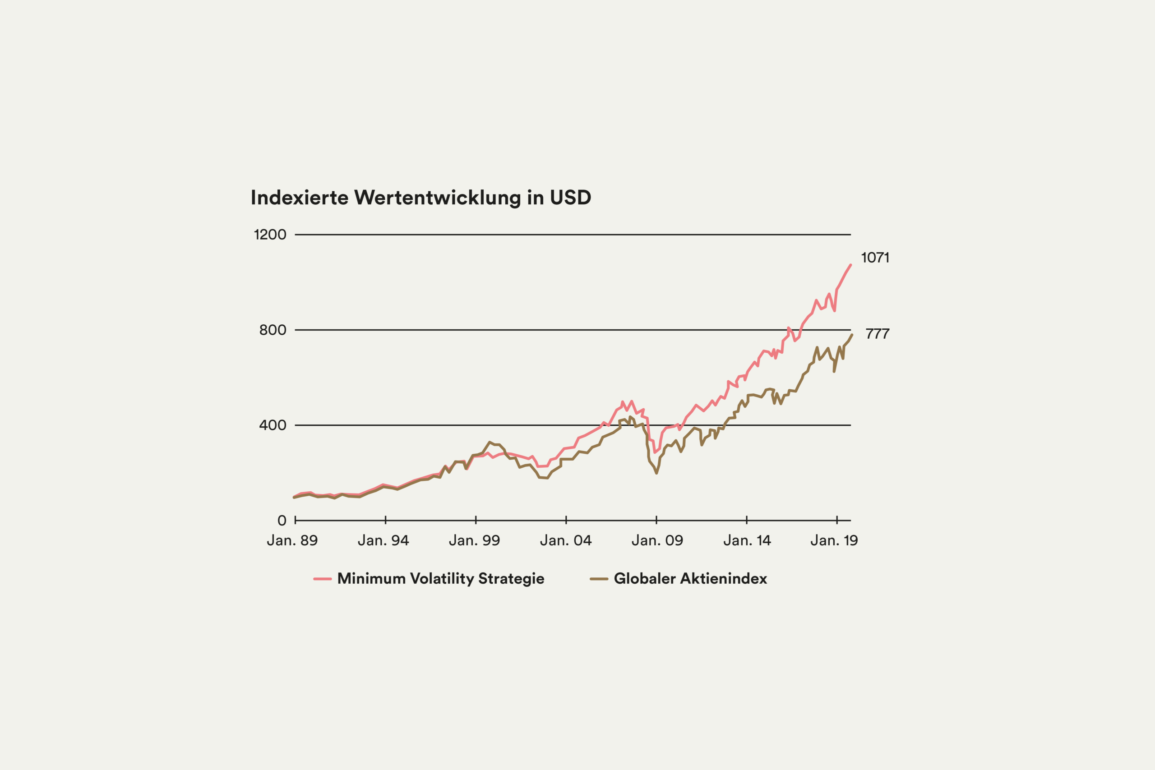

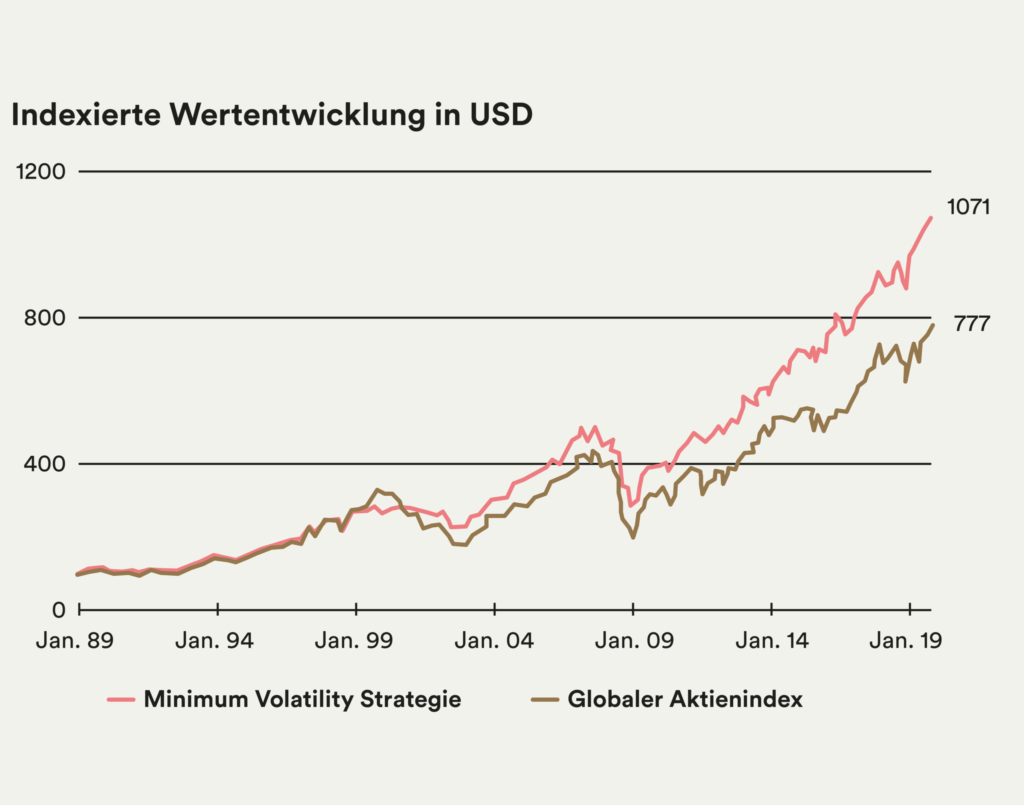

The traditional theory of the financial markets states that higher (systematic) risk (measured by the volatility of the share price) should be balanced out by higher returns. In practice, however, a different phenomenon has been observed on the share market for decades. Over the long term, shares with low volatility generate bigger returns than riskier stocks do (see graphic 1). In expert circles, this strategy is known as ‘minimum volatility’.

However, it does come with a catch. When the stock markets are on the up, this strategy often lags behind the market cap index. That said, this deficit is more than made up when share prices head southwards. Overall, investors using a minimum volatility strategy attain higher returns for less risk, over the long term.

To avoid falling too far behind an index when share prices are increasing, it is recommended that the portfolio includes shares that meet specific quality standards. We recommend balancing out one-third of quality stocks with two-thirds of minimum volatility shares.

Look for quality

You should bear three criteria in mind when selecting these quality stocks: rating, quality and volatility. Checking the rating helps you avoid buying over-priced shares. Specialists generally define a company’s quality by reference to its consistent high profitability, as well as aspects such as low levels of debt financing and high operational efficiency. In terms of volatility, make sure not to include companies with particularly volatile share prices in your portfolio.

If you were putting together a quality portfolio for the global equity market, you would include well-known individual stocks from Louis Vuitton (LVMH) and Novo Nordisk. Technology companies from the New Economy, such as Apple, Amazon and Alphabet (formerly Google), also meet the above quality standards. The best Swiss companies, from our perspective, are Emmi, Lonza and Sika.

Diversify your portfolio

For reasons of diversification, it makes sense to add Swiss real estate and gold to your portfolio as an alternative to shares and bonds.

Investing in real estate can either be done directly, in the form of an apartment or house, or indirectly via real estate shares and funds. This latter option is an essential component of a charity’s portfolio. The prices for indirect investments in real estate have jumped sharply recently, but there are still attractively rated stocks out there, such as Novavest Real Estate AG or SF Urban Properties AG.

An environment marked by low interest rates and an increasing expectation of inflation is a golden opportunity for, well, gold. Gold has always been seen as a safe haven that offers protection for your portfolio. From our perspective, the price of gold looks set to rise again in the foreseeable future. However, you should bear the exchange rate risk in mind, given that gold is traded in US dollars. In light of the interest rate difference between US dollars and Swiss francs at the moment, and the high hedging costs associated with this, we would not currently recommend (fully) hedging against the exchange rate risk.

In sum, it is clear that the success of a charity’s assets lives and dies by the right strategy, implemented in a professional, disciplined way – but don’t forget to keep an eye on the risks at all times. Have you chosen the right strategy? And have you correctly assessed the risks you’re facing at the moment?

Ask your financial advisor.