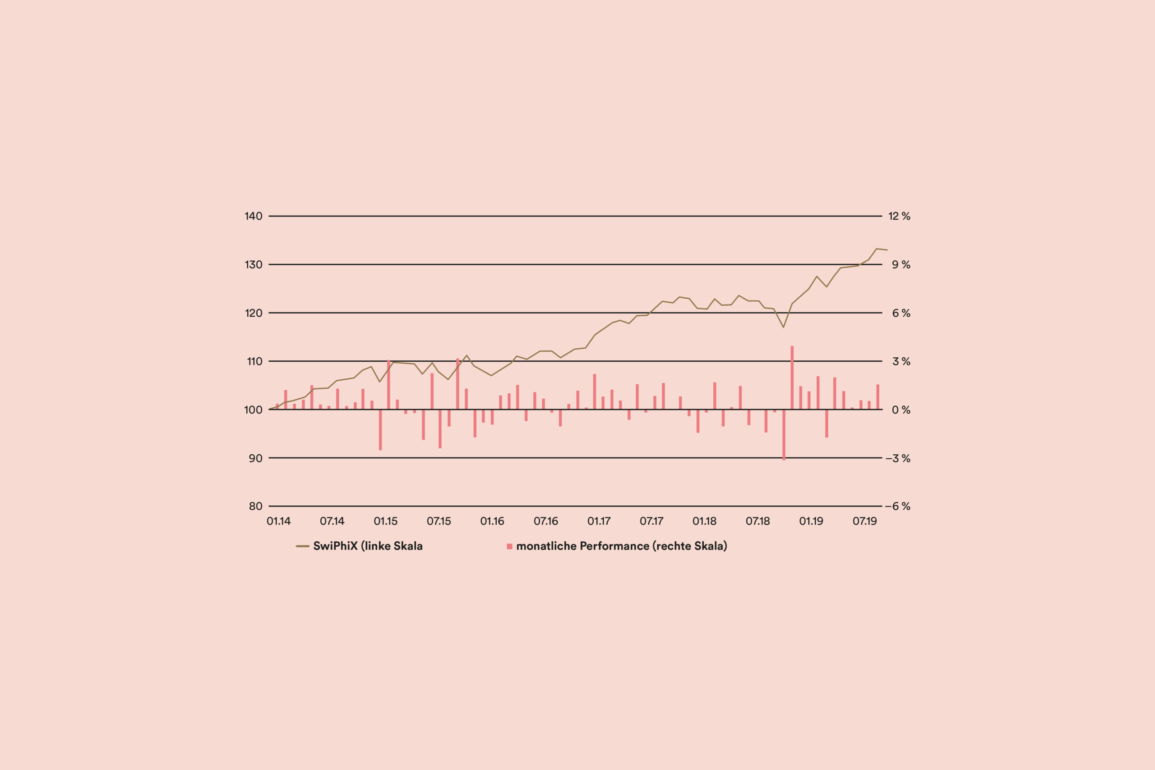

For 2019, the average performance of the ‘Swiss Philanthropy Performance Index’ (SwiPhiX) lay at 13.8 percent. The performance shows how the value of the assets, combined with dividends and other income, has developed. The 13.8 percent represents the average of mandates issued by charitable organisations and managed by Swisscanto Invest by Zürcher Kantonalbank. At the end of 2019, this amounted to 56 different mandates with a total volume of 1.8 billion Swiss francs.

Impressive performance

Charities can choose from a broad range of strategies for managing their wealth, and the performance that is generated can vary just as widely. The performance index illustrates how results are distributed, with the aim of depicting this in a transparent manner. In 2019, the minimum performance was 8.1 percent, and the maximum 28.0 percent. Performance over the last five years is also impressive: the maximum performance over this period was 26.7 percent, while the minimum performance was 12.4 percent and the mean 22.6 percent.

It’s not just about shares

In an environment shaped by negative interest rates, shares are beginning to take centre stage. When grading results, the key lies in how charities’ wealth is invested. The performance index also offers transparency here. Traditionally, charitable organisations invested heavily in bonds, and in conjunction with liquidity, or credit balances, these relatively secure assets still make up half of their investments. The proportion of shares is currently around 40 percent. The remainder is divided between indirect real estate investments and alternative investments such as commodities and hedge funds.

The ‘Swiss Philanthropy Performance Index’ will be calculated monthly, and published at stiftungschweiz.ch, where further details and information can also be found.