New financing models and innovative solutions based on entrepreneurial principles: Brainforest’s novel approach to achieving global CO2 targets.

It has long been scientifically clear that forests have tremendous potential to bind CO2 from the atmosphere. Unleashing this potential, however, will take a concerted effort – and fresh ideas. Science shows that it is achievable – as the non-profit association Brainforest aims to demonstrate. As an impact venture studio for forest and climate, Brainforest develops sustainable solutions for more forest and a better climate. Two such solutions are already taking shape. The Xilva AG is developing a global online marketplace that ‘offers potential investors a transparent, simple and innovative way to invest in forest projects, making it significantly easier to obtain CO2 certification’, explains Susanne Wittig, co-founder of Brainforest. However, the focus on CO2 is only the beginning. ‘Our activities explicitly centre around forests, including all their ecosystem services,’ she says. The second venture is the Ecosystem Value Association (EVA), which aims to create a digital forest climate standard. Wittig points out: ‘The aim of EVA is to develop standards for the evaluation of ecosystem services, as well as to make those services visible and furthermore enable them to be used economically – in other words, to set economic incentives in order to fight climate change.’ The first stage focuses on the creation of a climate standard for the reforestation of deforested areas in Germany due to climate effects. The intention is that by the end of this year, German forest owners will be able to benefit economically from their role in curbing climate change through CO2 certification.

Brainforest has also taken a unique approach to financing, combining both philanthropic capital and impact investment capital, as the two complement one another. ‘Philanthropic capital serves as our venture capital,’ explains Wittig. In order to take an innovative approach to tackling climate change, organisations must have the courage to experiment. However, regenerative business models, for example, are often research-intensive and do not appeal to traditional investors. Here, donations can help facilitate investment in ‘impact first’ ventures. ‘It means that the project attracts more investments – which ultimately enables the venture to have an exponential impact,’ notes Wittig. Clarification is required in advance as to whether it is a donation or an investment – ‘This distinction line is drawn with the incorporation of the venture,’ she says.

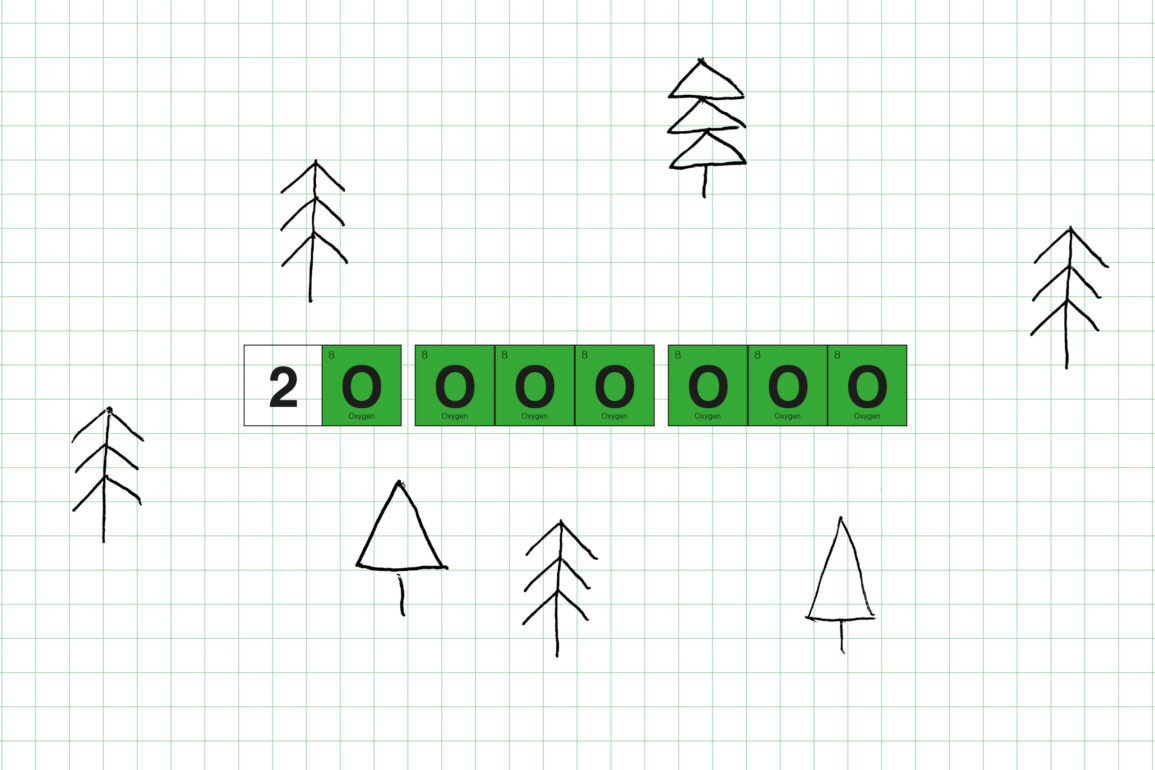

The idea for a solution to the development and establishment of the business model starts in the Brainforest Venture Studio. Donations and returns from the ventures fund the tax-exempt association, allowing impact investment capital to further circulate with each independent venture founded. This type of broad financing makes the pioneer projects attractive to a wide range of investors and backers, with the first being the Migros Pioneer Fund. The studio has since attracted funding from foundations, private investors, family offices and a sustainable bank. It is hoped that in this way, Brainforest will enable 20 Million hectares of additional forest absorbing more than 3GT CO2 by 2050.